ASIA NETWORK

The Asia regional network currently spans from New Zealand in the East, includes major economies such as Japan and China, and reaches India, Sri Lanka, and Pakistan in the South East. It is a large and diverse network in terms of its economic stages, culture, and language as well as energy issues it faces.

Key issues for the Asia region currently include accelerating the pace of transition to carbon neutrality, mitigating the risks associated with digitalisation and implementing new market design mechanisms. Recently, hydrogen has moved to the forefront of the discussion in many Asian countries as a potential way to decarbonise.

Regional action priorities that support the Council’s mission and humanising energy vision are agreed on an annual basis by national Member Committees in the framework of a Regional Action Plan. In 2021, Asian members joined forces to drive forward conversations on the future of hydrogen in the region.

Each month, the Asian regional network meets to discuss matters of mutual interest, drive collective activities, and keep each other updated on relevant developments and events. In addition, throughout the year regionally targeted workshops are being organised to advance discussions in the context of our global insights and innovation tools.

To drive action and achieve impact, members in the region work in partnerships with energy-related non-governmental agencies and other regional energy organisations including the Asian Development Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), Asia Pacific Economic Cooperation (APEC), the Asia Pacific Energy Research Centre (APERC), the Institute of Energy Economics, Japan (IEEJ) and the Association of Southeast Asian Nations (ASEAN).

Conversations on hydrogen brought together stakeholders from the region and beyond.

A first webinar The Future for Hydrogen in the Asia Pacific was led by the Japanese Member Committee and explored the different drivers for hydrogen demand and emerging national hydrogen strategies, drawing on key findings from a recent Council survey.

A second webinar was co-hosted by the World Energy Council Hong Kong, WBCSD and ERM under the theme of The Emerging Hydrogen Economy in the Asia Pacific Region. The discussion built on the Council’s Innovation Insights Briefing Hydrogen on the Horizon: Ready, Almost Set, Go? and focused on different hydrogen strategies and action priorities in the Asia Pacific region and used.

Energy in Asia

REGIONAL OVERVIEW & CONTEXT

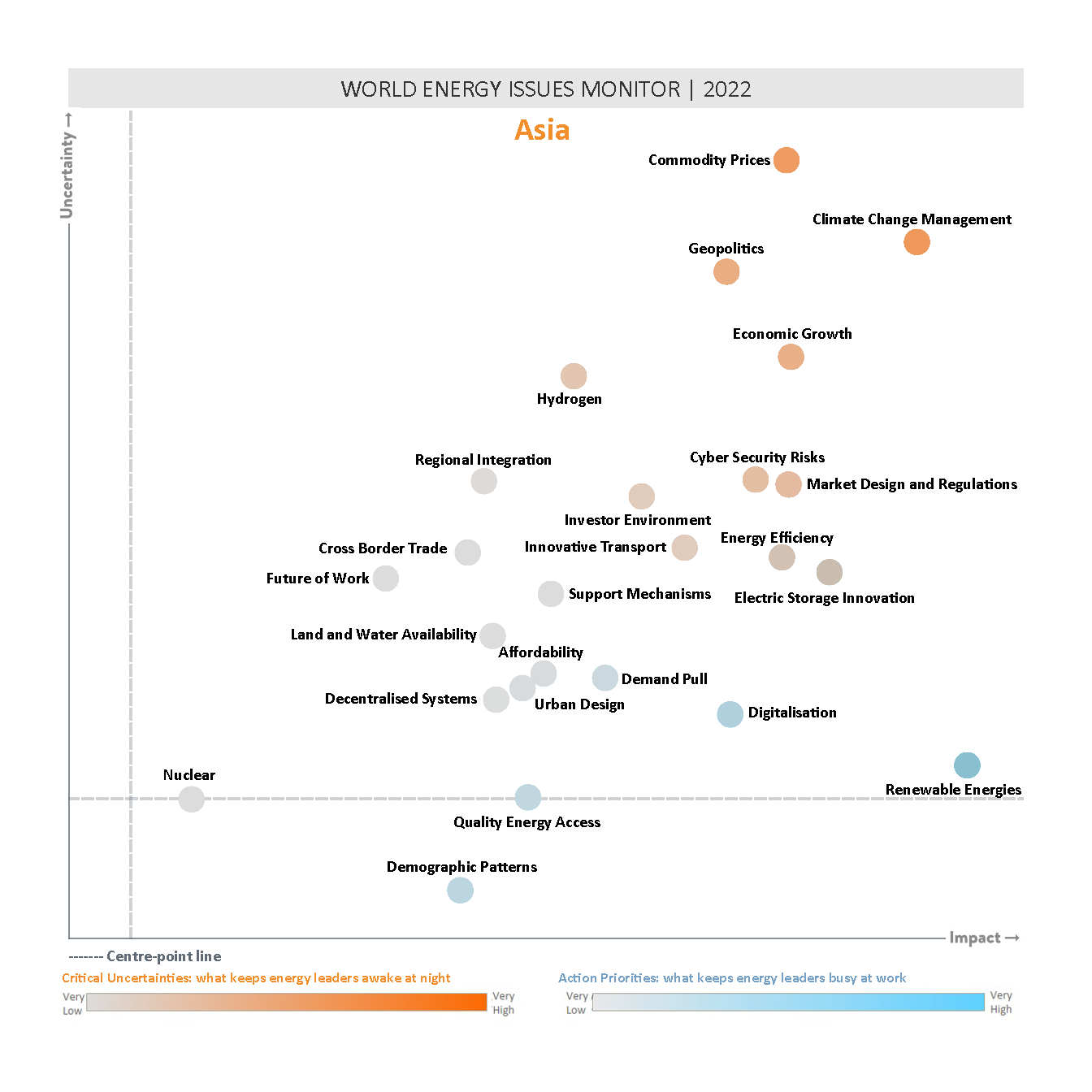

Consistency is the theme across Asia, with the 2022 Issues Map remaining remarkably aligned between 2021 and 2022. Commodity Prices and Geopolitics stand out as the Critical Uncertainties, with the region strongly impacted by energy security concerns and large price rises in energy costs. Hydrogen scores highly on the Critical Uncertainties quadrant and is accorded more interest than many other regions.

Few issues appear in the Action Priorities quadrant, with Renewable Energies, Digitalisation and Quality Energy Access topping the list of what is keeping energy leaders across the region busy at work.

ASIA DEEP DIVE

With a population of 4.5 billion, representing 40% of the world’s total, this large continent is extremely diverse geopolitically, economically and geographically, so care must be taken to avoid generalisations. In this region, energy transition continues to occur at different speeds and via different routes.

The Challenge: Diversifying the energy mix in times of uncertainty

Many countries in the region are experiencing rapid population growth which, coupled with weak economic growth, is leading to poverty. The impact of COVID-19 and geopolitics have accelerated the economic and energy disparity that was already evident pre-pandemic.

Fossil fuel dependence raises uncertainty and concerns about energy security, particularly as financial institutions commit to phasing-out investment in coal power projects as a response to decisions taken at COP26. This is of particular concern for Mongolia, which has a greater than 90% dependence on coal power. The country is double impacted by climate change management and commodity prices fluctuations, as it counts on indigenous fossil fuel production for 80% of its energy needs, and on 20% imports from neighbouring countries, Russia and China, to fulfil its growing energy demand.

Due to its condition of net importer of natural gas (70% indigenous and 30% imported), Pakistan also perceives high vulnerability to fluctuations in commodity prices. This perception has further aggravated with the significant increases in the price of imported gas in recent months.

In this challenging context, countries across the region see no one single energy source as sufficient to balance the Energy Trilemma of energy security, sustainability and affordability. Instead, there is a shared view that diversified pathways must be followed to reduce risk and achieve carbon reduction/net-zero targets.

"There is no single energy source we can use to wipe out this uncertainty.

Masaaki Hanaoka, Senior Executive Director, Japan Energy Association / Secretary General, Japan Member Committee, World Energy Council, Japan

Yet, Asian countries have pledged carbon neutrality, or committed to massive carbon reduction, which will affect business and social activities. This year’s Asia Issues Map reflects mixed sentiment of anxiety, frustration, significant challenges and economic concerns. Against this environment, energy transition is seen as an imperative, with many countries continuing to invest in renewables, nuclear, hydrogen and sophisticated grid-management systems.

"Fossil fuels will phase out in a periodic manner as the supply chain and technological constraints for renewables are managed by stakeholders during the energy transition. There is no doubt that natural gas is here to stay for at least another decade.

Umair Ahmed, Deputy Manager - Strategy, Engro Corporation, Pakistan/ Future Energy Leader, World Energy Council

The Opportunity: Greater clarity around renewables strategies for multinationals, as end-users, and for commercial investors

The region is still lagging in the production of renewable energy and most of the existing developed capacity was stimulated through Feed-in-Tariffs or special programmes. With many of these coming to an end, or being reset, there is an opportunity to reframe the policies and adapt commercialisation models to accelerate transition. This is occurring in China, the Philippines and some other countries across the region. Simultaneously, the cost of renewables technology has fallen, making implementation more favourable.

"Merchant markets will see they can make more money moving faster towards renewables as they are displacing ever more volatile and expensive fuel, and it will be harder to get funding for long-term gas contracts (too much uncertainty). This uncertainty steels the resolve to move to things that are less exposed to this risk – that will be the shift factor in policy and commercial opportunities.

Mike Thomas, Managing Director, The Lantau Group, Hong Kong SAR, China

Technological breakthroughs are seen as key to energy transition. In electric vehicles, there is competition in lithium-ion cells between lithium iron phosphate, and nickel manganese cobalt oxide, and potentially also with sodium-ion batteries. The different technological roadmaps will impact the development of electric vehicles and also alter the demand for different commodities.

With respect to Hydrogen, which features as a Critical Uncertainty in this year’s Asia Energy Issues Map, there are still multiple technical challenges to be overcome. In addition, international supply chains will need to be developed to accommodate the volumes predicted, and existing infrastructure will need to be re-purposed.

"Market disruption comes down to market design. We need to learn from past problems and review our existing market design.

Sam Muraki, Executive Advisor, Tokyo Gas Company / Regional Vice-Chair for the Asia Pacific and South Asia, World Energy Council, Japan

The Need: Facing the challenge of energy transition together, globally

Comparison of the Asian and Global energy Issues maps shows that energy prices and geopolitics increase in uncertainty from 2020 to 2021 regionally and globally.

Within the region, countries share the view that carbon neutralisation cannot but be addressed as a global issue, and that international collaboration and global solutions are required. At a country level, the government of Japan has targeted 14 key areas in its carbon-neutral strategy, including demand-side management. The Chinese government continues to emphasise that cutting emissions is not aimed at curbing productivity or achieving zero emissions, that the economic development and green transition should be mutually reinforcing, and that no ‘one-size-fits-all’ approaches should be adopted.

The region also shares concerns of geopolitical tension and conflict as extremely harmful to international collaboration and of their negative impact on energy transitions. For example, there is close attention to how the escalating conflict in Ukraine can impact LNG markets as prices go up, and as demand and prices become increasingly tied.

Downloads

Regional Perspectives - World Energy Issues Monitor 2022

Download PDF

World Energy Issues Monitor 2022

Download PDFDownloads

Renewable Energy Systems Integration in Asia - Full Report

Download the Report

Renewable Energy Systems Integration in Asia - Executive Summary

Download the Executive Summary

_368_520_s_c1_c_c.png)