North America Network

The North America region currently consists of Mexico and the United States of America. As significant energy producers and consumers, energy plays a critically important and highly valued part in the North American economies. The transition to clean energy therefore creates both large challenges and major opportunities which drive the region’s action priorities.

Regional action priorities that support the Council’s mission and humanising energy vision are agreed on an annual basis by national Member Committees in the framework of a Regional Action Plan. In 2021, key topics of interest to members included hydrogen as a key constituent in the future energy economy, advanced nuclear/SMR’s and transportation electrification needs and challenges.

The region has also addressed their countries’ unique issues and challenges at energy forums and workshops focusing on topics such as, replacement of nuclear, regulation on CCS technology, smart energy policies, energy efficiency with advanced technologies, and trade issues.

The region organises the World Energy Council official regional forum, the North America-Latin America bi-regional forum which addresses energy efficiency, energy conservation, alternative energies, energy transport and fossil fuels issues.

Energy in North America

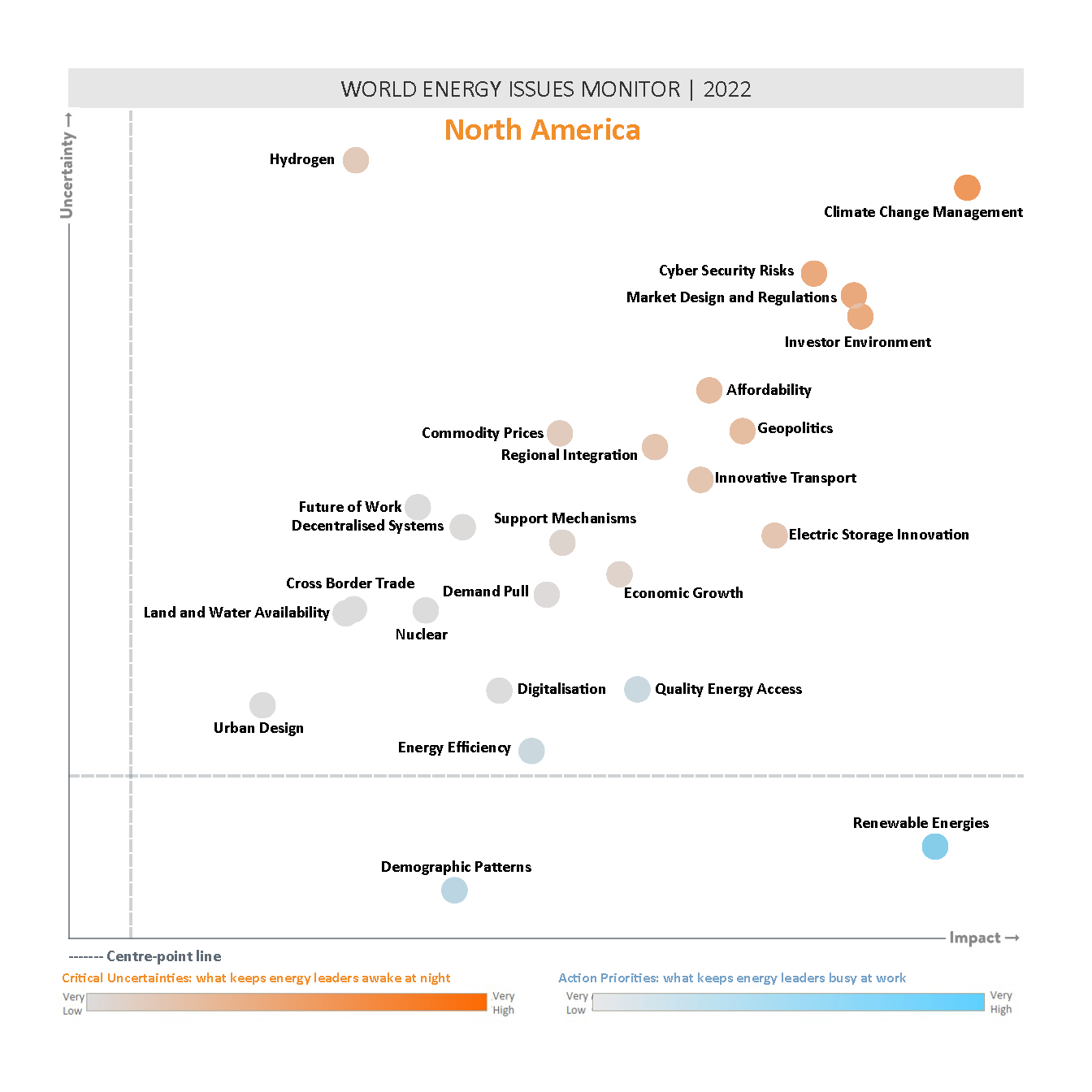

The North America Issues Map bucks the global trend – attributing the highest degree of impact and uncertainty to Climate Change Management, with Commodity Prices seemingly less of an issue than across the rest of the world. But uncertainty remains high, with the region following the global pattern of clustering uncertainty and few clear Action Priorities.

Hydrogen makes an appearance as a critical issue, moving from low to high uncertainty compared with the 2021 map, and Renewable Energies remain as a defined Action Priority, with the degree of uncertainty reducing over the past year.

NORTH AMERICA PERSPECTIVES

The investment environment is experiencing a high degree of uncertainty, due to inflation. For the first time, the amount of money put into the economy will fall. Rising interest rates raises capital cost, and lowers the amount of capital, leading to a bigger gap between winners and losers.

There is no surprise from the financial market point of view that uncertainty has increased. It has its roots in COVID, and the region sees opportunities and risks in trying to manage global energy transition. A business approach to transition will be key.

The Challenge: Climate change and management

Climate change management is in the top five critical uncertainties globally and is the biggest one for the region

"There is a growing concern that climate change is recognised as a societal risk, but that there isn’t a common understanding on the potential severity. That uncertainty in being able to quantify the risk at an individual level is causing some confusion.

Mike Howard, Emeritus CEO, Electric Power Research Institute (EPRI), USA

North America is in a unique position with respect to climate change management – The Federal Government is a very weak regulator, whilst individual states are strong regulators, creating unevenness across the country, impacting on how transition moves forward.

In Mexico, the Issues Map results reflect uncertainty around the energy policy implemented at the beginning of the current federal administration, which has moved away from the 2014 Energy Reform for market liberalisation. The country’s Electric Energy Law bill presented in October 2021 is aimed at rescuing the state oil company PEMEX with the view of, together with the national electricity company CFE, achieving energy self-sufficiency. The bill envisions the use of heavy oil and coal for electricity generation. Further uncertainties centre around policy and regulatory frameworks for clean energy, together with issues of import dependence and energy security.

In Canada, uncertainty about climate change is dominant. The country is in the top 10 ranking per capita for emissions and little progress on climate change management has been made in the past 10 years. There is significant frustration, resulting from setting and missing targets because planning and regulatory frameworks are not in place. Despite a carbon price at federal level, there is recognition in the industry that pricing will not solve the problem on its own and needs to be combined with targeted incentives and regulations. Additional uncertainty surrounds an appreciation of the magnitude of investment needed for transition and the need to stimulate public-private partnerships and cooperation among different levels of government. There are some positives to report – much work has been done in reducing methane emissions. CCS with generation was first built in Canada, at the same time as sequestering hydrogen from refineries, and the country is also now building the first nuclear facility in three decades.

The opportunity in uncertainty: Getting investments right

How can uncertainty continue to increase? Energy leaders in the region think it is because people are more aware of the issues and are increasingly eager for answers. For example, with respect to hydrogen, there is now much greater awareness of hydrogen as part of a future energy system, but it is still not clear what the impact will be and how the technology can be deployed and over what timeframe.

"Why has the uncertainty in hydrogen gone up, when we always talk about and invest in hydrogen? It’s because more people are more aware that hydrogen is part of the solution. And they are less clear about how it’s going to play out.

Neil Wilmshurst, Senior VP, Energy Systems Resources, Electric Power Research Institute (EPRI), USA

Concerns about affordability and inflation are also at front of mind. There is severe stress on supply chains, fuel costs and transport costs. Some of this can be traced to the impact of the pandemic and may be transitory, but some of it results from a change in behaviour as a result of decarbonising. There has been a big reaction from companies and markets to not spend as much money as they would usually in response to higher prices.

Another contributor to the climate of uncertainty relates to the timing of investment decisions: When will investment decisions for infrastructure be made with the 2050 target in mind? By the early 2030s the infrastructure for 2050 will need to be locked in – this leaves just 10 years to solve uncertainties, gain acceptance, and put the financing in place. Uncertainty comes from the ‘closing window’ and concerns about exactly what to build, where to position it and the availability of raw materials.

Additional concerns surround transitioning existing assets in the most cost-effective way. Gas plants are likely to be phased out, but there is no clear timeline or defined roadmap to what will replace them. There will be impact on other components of the energy system and consideration should be paid to bringing new technologies into operation in a timely manner.

"We have 10 years to get the uncertainties figured out so that the market sees these options as investable. That’s where the uncertainty is coming from, people realise the window is closing, and it’s closing fast.

Neil Wilmshurst, Senior VP, Energy Systems Resources, Electric Power Research Institute (EPRI), USA

Some very new technologies are seen as essential; for example, hydrogen, particularly for thermal energy in building high-temperature applications in industry. Most work on hydrogen in Canada has been focused on fuel cells for the transportation sector with less emphasis paid to its application in thermal energy. Work in the UK, Germany and the Netherlands shows it may be possible to change natural gas delivery infrastructure to using 100% hydrogen, but this is a long way off. There is progress, but movement from discovery, to building, to commercialisation takes a significant amount of time. Energy leaders think there is a significant opportunity for Canada to work with the US on the systematic selection of key technologies for energy transition, including hydrogen.

The Need: To get people onboard and to cooperate for shared goals

The biggest challenge to climate change is an unhappy population. Across the region, there is massive unhappiness with energy prices, which has slowed down movement on decarbonisation. There is a need to have some environmental context in ‘Build Back Better’ to make change affordable. Subsidies, nuclear, expansion of credit for renewables, introduction credit for hydrogen, are all considered critical to the affordability of transition and to ensure that the politics of transition are not impacted negatively

"The biggest risk to moving forward from a policy perspective is that your population is unhappy. And there is no question that globally we have seen a response that [the] population are unhappy about what has happened to energy prices. That has slowed down the movement that was underway.

Dan Ford, Power and Utilities Equity Analyst / Board Member, Electric Power Research Institute (EPRI), USA

The problem of transition costs and social acceptance for the region is therefore very accurate. Transition costs are not known precisely, but astounding numbers are frequently quoted. Will we be able to make those investments? Are there any lessons from dealing with the COVID pandemic that are applicable for climate change management? While COVID is a source of uncertainty, there has been tremendous amounts of investment in R&D to combat the virus, and also unprecedented international collaboration which enabled vaccine development in record time. Our experience of the pandemic shows that international collaboration is possible, but is there the will to transfer this to climate change? This will be a critical factor moving forwards.

But, in all the concerns about policy, technology, finance and infrastructure, it must not be forgotten that energy transition is a human issue. We must consider the future work force – where will they come from? How will they be reskilled? What does the societal impact look like? How are new technologies, such as AI going to be implemented? And will the current mobility/flexibility in working practices initiated by the pandemic continue to be part of the future of work.

Social equity issues are going to be significant if not managed correctly. If energy transition is not made equitable then everyone will lose.

Downloads

Regional Perspectives - World Energy Issues Monitor 2022

Download PDF

World Energy Issues Monitor 2022

Download PDFAs part of World Energy Week LIVE 2021, a conversation focusing on Turning points in the global e-mobility transition was convened. Participants engaged in a dialogue about the electrification of transportation and how it is accelerating on many fronts globally, driven by national policies and enabled by rapidly evolving technologies and decreasing costs. As part of the discussion, they highlighted the importance for both national and community stakeholders to clearly understand the pace of change within the transportation sector and to develop strategies and programs to remove obstacles to the adoption of electric vehicle technologies. As part of the conversation participants encouraged stakeholders involved to consider what the key technology issues are that must be addressed to ensure that the global e-mobility transition meets its objectives, what steps economies as well as impacted communities can take to ensure that their residents can fully participate in the environmental and economic benefits of e-mobility, and shared lessons learned from North America that can offer guidance to other countries and communities in their own e-mobility transition.

_368_520_s_c1_c_c.png)