Middle East & Gulf States Network

The Middle East and Gulf States region includes major energy producers but also some of the fastest-growing energy consuming countries. The diverse regional community provides national Member Committees and their members with opportunities to expand and deepen their network and engage around activities and events – from young energy professionals to CEO and Ministerial level – on topics of interest to the members.

Regional action priorities that support the Council’s mission and humanising energy vision are agreed on an annual basis by national Member Committees in the framework of a Regional Action Plan. In 2021, key topics of interest to members in the region included the future of hydrogen in the region, the development of a circular carbon economy framework as a comprehensive approach in utilising all available levers for emissions reduction, and conversation about inspirational projects for sustainable energy.

Each month, the Middle East regional network meets to discuss matters of mutual interest, drive collective activities, and keep each other updated on relevant developments and events.

As part of World Energy Week LIVE 2021, a conversation focusing on Circular carbon economy in the Middle East was convened. Participants discussed, how currently mature solutions to address climate change such as energy efficiency and renewable energy are necessary but not be enough to achieve the goals set in the Paris Agreement. They highlighted that in the Middle East and Gulf States, there is a need to develop and deploy technologies of varying maturity to address emissions reductions across multiple sectors. Participants debated how a circular carbon economy framework may provide a comprehensive approach in utilising all available levers for emissions reduction and thereby. address the challenge of climate change while generating socio-economic value by creating valuable products from CO2.

Energy in the Middle East

REGIONAL OVERVIEW & CONTEXT

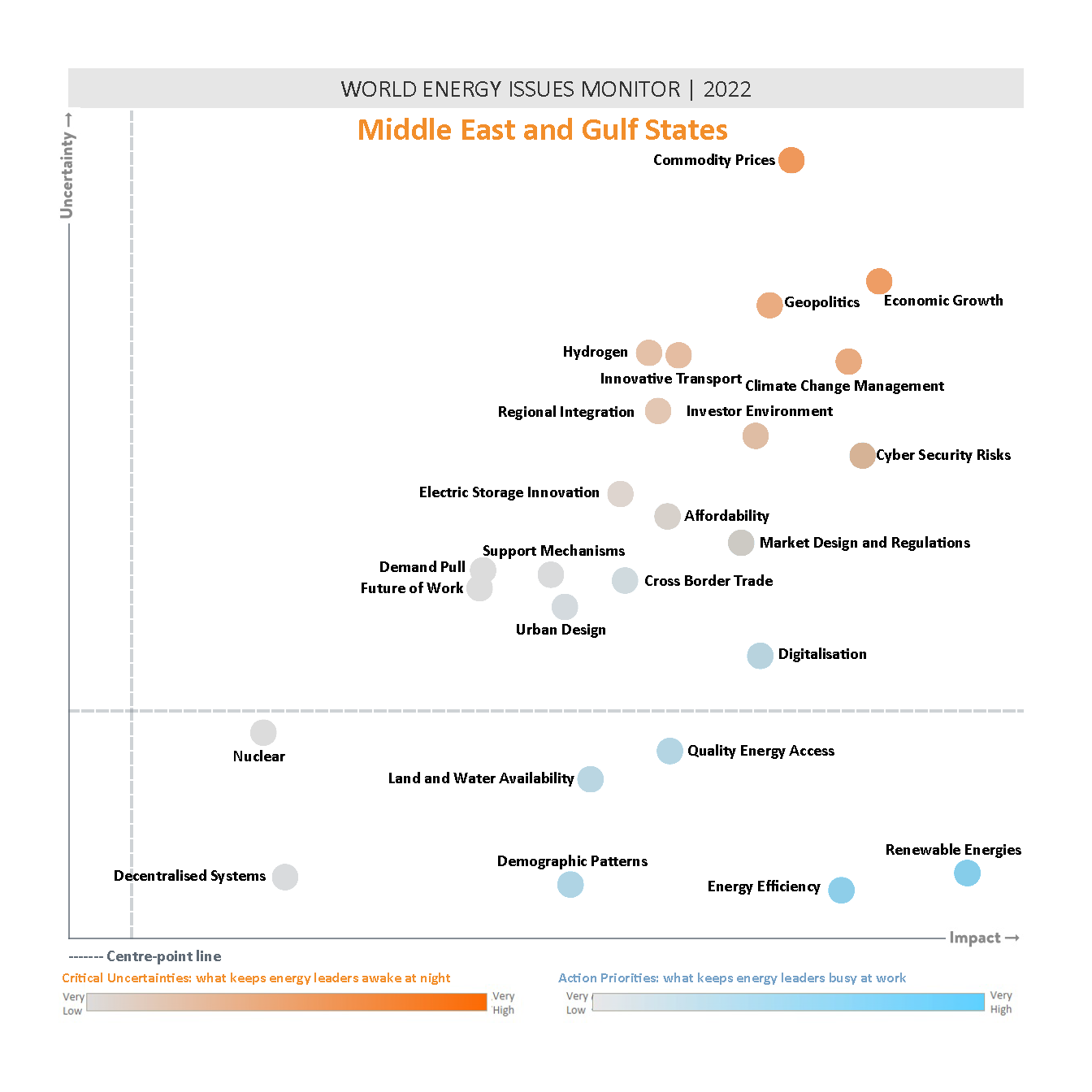

The Middle East and Gulf States (MEGS) continue to be aligned with the overall global Issues Map, with higher uncertainty overall and Commodity Prices and Geopolitics rising up from Action Priorities to Critical Uncertainties.

Commodity Prices top the list of Critical Uncertainties, closely followed by Economic Growth and Geopolitics, which show enormous shifts over their relative 2021 position. Hydrogen also increases up the uncertainty axis.

Renewable Energies, Energy Efficiency and Land and Water Availability remain Action Priorities, as consistent factors in the region’s energy transition strategy.

MIDDLE EAST AND GULF STATES DEEP DIVE

This year’s Issues Monitor Survey results cover four countries across the region: two (Lebanon and Jordan) are net oil importers, and two (United Arab Emirates and Saudi Arabia) are oil producers.

The high overall uncertainty rating is strongly influenced by the pandemic context and is particularly reflected in the high scores afforded to Economic Growth, Geopolitics and the Investor Environment in this year’s map.

Deeper analysis of the survey results shows additional Critical Uncertainties for the region include Institutional reliability and continuity, the long-term impact of the pandemic, the future of oil and gas demand, greenflation and financial crisis, as well as transition costs and societal acceptance of energy transition.

Energy leaders in the region question whether the high degree of uncertainty across so many issues makes it difficult to take action, and shift into Action Priority mode. Uncertainty impacts decision making and presents a challenge for policy setting.

"If climate change is the biggest challenge, uncertainty is only an excuse. This is a challenge of setting policies.

Dr Mari Luomi, Research Fellow II, King Abdullah Petroleum Studies and Research Center (KAPSARC), Kingdom of Saudi Arabia

There is an acknowledgement that the momentum of a sustainable post-COVID recovery has been lost – and disappointment that there is no real mention of a green recovery even at COP26.

Nationally determined contributions (NDCs) from 6 GCC countries are in place, but despite huge levels of interest in hydrogen and Carbon Capture, Utilisation and Storage (CCUS), very few tangible quantitative targets have been set.

Energy leaders agree that governments need to set clear mid-term targets (through 2030) and implementational roadmaps to deliver on COP26 pledges.

The next two COPs will be held in the MEGS region (COP27 in Egypt in November 2022, and COP28 in the United Arab Emirates in the following year), indicating the region’s ambition and commitment to energy transition and climate change mitigation.

The Challenge: Oil & Gas reliance

The region is still heavily dependent on its indigenous oil and gas reserves, and faces unique challenges when it comes to financing, land allocation and providing an attractive investor environment to facilitate energy diversification and transition.

Countries within the region are, however, looking to global partners to collaborate on energy transition solutions around demand-side management, energy efficiency, CCUS, hydrogen and smart transportation.

"The UAE exerts efforts towards diversifying energy sources as it is the foundation of achieving a balance between sustainable development and environmental preservation.

H.E. Eng Yousif Al Ali, Assistant Undersecretary for the Electricity, Water and Future Energy Sector, United Arab Emirates

The Opportunity: New momentum for digitalisation, energy efficiency, and renewable energy

New opportunities for the region are presented by diversification to renewable energies, energy efficiency and digitalisation. For countries like Jordan and Lebanon, which do not have sufficient oil and gas resources, there is a pressing need to invest in renewable energies to increase energy security.

Jordan now has a track record in deploying renewable energies and implementing energy efficiency measures. The participation of renewables in the country’s energy mix is 25% and the country has a plan to export green energy to other countries, including Europe, in the near future. Coupled with an e-Mobility project and a smart grid and storage initiative, the country is aiming to reach 30% renewables penetration.

The UAE has made significant progress in the past year in renewable energy deployment. Today, the country stands on a large clean energy capacity (solar and nuclear). This is a great achievement, but the country’s leadership has more ambitions and is confident of achieving net-zero by 2050. However, more needs to be done on pathfinding to 2050.

The MEGS region lacks transport networks – plans, strategies and investment are all required to improve mobility. This represents a huge challenge and opportunity for the region that will require significant investment.

Hydrogen-fuelled transport is being considered as part of the solution, particularly in the UAE, which is looking to stimulate commercial interest in hydrogen production. In the mid- and short-term, the UAE hopes to showcase the export of blue hydrogen and ammonia by COP28 and believes it can make the case for hydrogen in the UAE.

Other issues to be addressed include water and land use/degradation. To counter these environmental challenges, ambitious waste management programmes are being undertaken in Saudi Arabia, Dubai and other Emirates in the UAE. Water availability is a constant challenge across the region and in the UAE in particular, where mangrove planting is being undertaken to tackle water scarcity.

The Need: To achieve net zero the region will need to excel on hydrogen on carbon management

The region is very focused on a net-zero target, as well as consolidating a circular carbon economy framework and carbon policy. The KAPSARC Circular Carbon Economy Index (of 30 countries) maps how countries are performing on the road to net zero/circular carbon economies.

Hydrogen is becoming more and more interesting for energy leaders and political decision makers globally and across the region. The UAE plans to achieve net zero by 2050 and this can only be done with hydrogen. Saudi Arabia and the UAE are making significant investments and developing partnerships, as are Morocco, Tunisia and Egypt. Costs for green hydrogen will need to be driven down so that the fuel is competitive with natural gas, with blue ammonia and hydrogen seen as transition fuels.

Regional energy system integration, electrification and interdependency are all issues to be addressed and provide focus for future Action Priorities.

Downloads

Regional Perspectives - World Energy Issues Monitor 2022

Download PDF

_368_520_s_c1_c_c.png)